Payments often involve more than just processing—they require precision. From ensuring mandatory fields are included to adjusting data for provider-specific requirements, even the smallest errors can lead to transaction failures. That’s where the Preprocessor steps in.

The Preprocessor is a smart feature designed to modify or substitute default data in transactions before sending them to a provider. It ensures every payment aligns with provider requirements, eliminating errors and keeping payments flowing smoothly.

Why the Preprocessor Matters

Payment providers often have strict rules about the data they receive. Missing fields, unsupported formats, or insufficient values can all result in rejected transactions. The Preprocessor ensures compliance without burdening merchants, handling issues like:

- Mandatory Fields: Filling in missing fields with default values.

- Data Formatting: Adjusting values to match provider specifications.

- Provider Compatibility: Replacing unsupported data, like converting IPv6 to IPv4.

Real-Life Scenario

Here’s how the Preprocessor solves common payment challenges:

1. Adding Default Values

Some providers require mandatory fields that merchants don’t collect. For example, if a provider requires a "Country Code" but the merchant doesn’t include it, the Preprocessor can add a default value, like "US," to meet the requirement.

2. Handling Character Limits

Imagine a customer named "Li," and the provider requires a cardholderName field with a minimum of 3 characters. Without the Preprocessor, the transaction would fail.

With the Preprocessor:

The system automatically adjusts the name to meet the provider’s requirement, for example:

- Expanding "Li" to "Li X" or "Li_".

- Combining additional data, like appending a placeholder value.

This ensures the transaction is accepted without disrupting the customer experience.

3. Adjusting Field Formats

Some merchants store first and last names separately, but the provider requires them combined into a single cardholderName field. The Preprocessor dynamically merges firstName and lastName fields into the correct format, ensuring seamless processing.

4. Converting Unsupported Data

If a provider doesn’t support IPv6 addresses but the customer’s IP address is in IPv6 format, the Preprocessor converts it to IPv4 before sending the transaction. This ensures compatibility without manual adjustments.

Key Benefits of the Preprocessor

- Compliance Made Easy

Automatically meet provider requirements, from mandatory fields to specific data formats. - Prevent Transaction Failures

Resolve errors before they happen, minimising rejected payments and chargebacks. - Save Time and Effort

Handle complex adjustments automatically, reducing the need for manual intervention. - Enhance Customer Experience

Ensure transactions are processed smoothly, keeping customers happy and confident.

How It Works

The Preprocessor operates behind the scenes, seamlessly modifying transaction data:

- Before Sending: It analyses the transaction for missing fields, format issues, or unsupported data.

- Dynamic Adjustment: Makes the necessary changes to align with provider requirements.

- Seamless Processing: Sends the corrected transaction to the provider for approval.

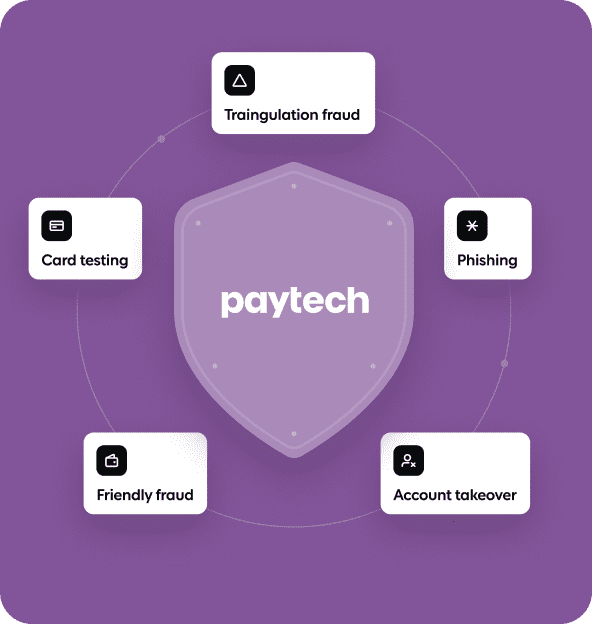

Why Businesses Choose paytech’s Preprocessor

At paytech, we know every payment counts. The Preprocessor is just one of the ways we ensure your payments flow smoothly, no matter the provider.

With features like Smart Routing, Cascading Failovers, and now the Preprocessor, your business can optimise every transaction and focus on growth.

Ready to Simplify Your Payments?

Let the Preprocessor handle the details so you can focus on what matters most—your customers.