In payments, every millisecond counts. A failed transaction isn’t just an inconvenience—it’s a lost customer, a missed revenue opportunity, and potentially a dent in your brand’s reputation.

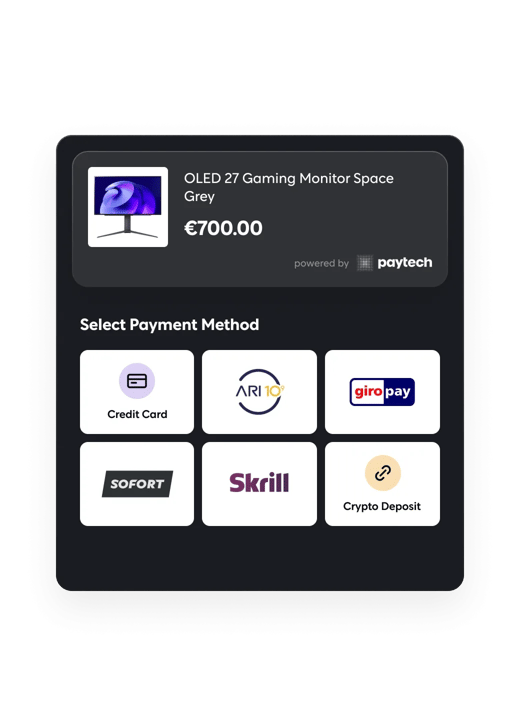

At paytech, we believe in eliminating guesswork from payment processing. That’s why we’re introducing the Routing Simulator, a game-changing feature designed to give businesses full visibility and control over their payment routing logic before transactions even happen.

Imagine checking how a transaction will process — which provider it will go through, optimise for better approval rates and remove the guesswork. The Routing Simulator makes this a reality.

The Problem: When Payments Feel Like a Black Box

Most businesses only realise there’s an issue after a transaction fails. Maybe it’s a provider outage. Maybe the card type isn’t supported. Maybe the routing logic isn’t optimised for a certain currency.

By the time you notice, you’ve lost a customer. They’ve either abandoned checkout or switched to a competitor with a frictionless experience.

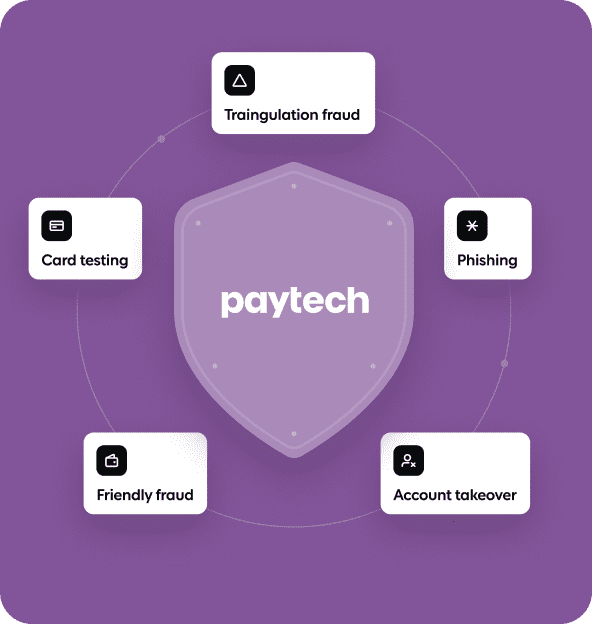

This lack of visibility leads to:

❌ Unexplained payment failures that leave merchants frustrated.

❌ Inefficient routing decisions that increase costs or lower approval rates.

❌ Provider dependencies that make businesses vulnerable to downtime or performance drops.

So, what if you could visualise your whole payment flow?

The Solution: Simulate Before You Commit

💡 Enter the Routing Simulator.

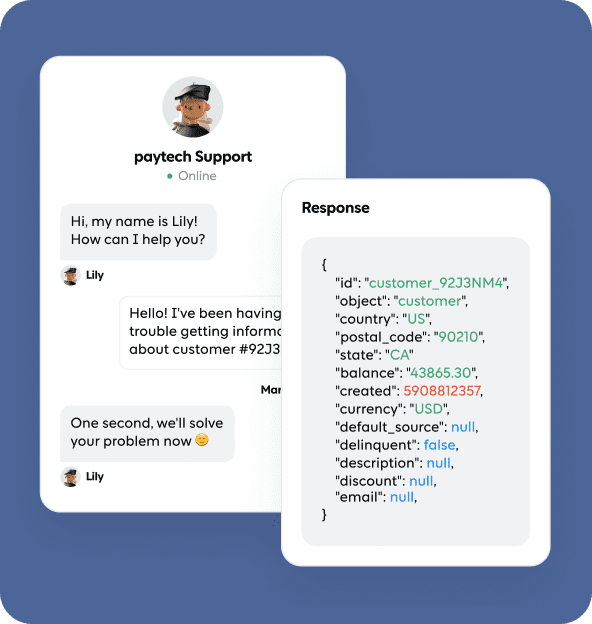

This tool removes the uncertainty from payment processing by showing exactly how a transaction would flow before it happens. It allows businesses to:

✅ See real-time routing logic – Understand how transactions are processed within your current setup.

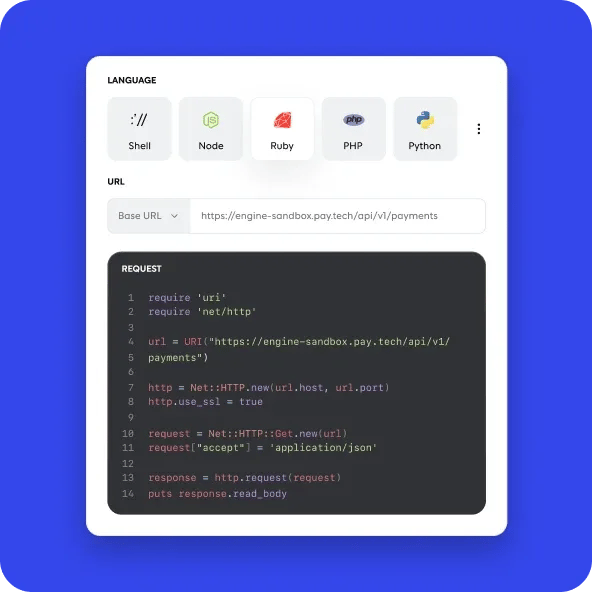

✅ Test changes before they go live – Adjust routing rules without disrupting real payments.

✅ Troubleshoot failed transactions – Instantly diagnose why a payment didn’t go through and fix issues proactively.

With the Routing Simulator, you’re in control—optimising approval rates, reducing costs, and ensuring seamless payment experiences.

Why Businesses Need the Routing Simulator

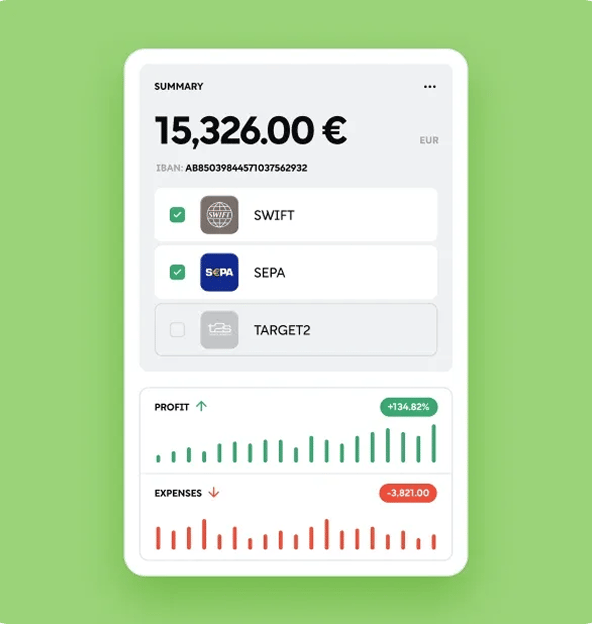

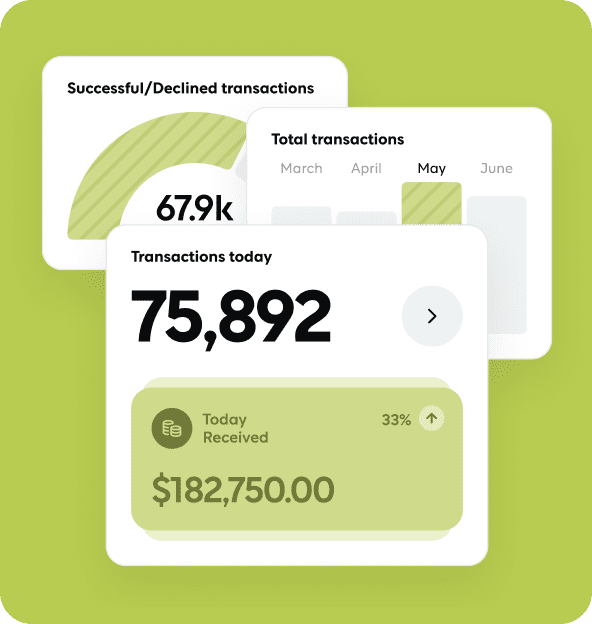

🔹 Boost Approval Rates – Ensure transactions always take the most efficient route.

🔹 Reduce Costs – Route payments strategically to providers with lower fees.

🔹 Increase Transparency – Know what happens behind the scenes before an issue arises.

🔹 Stay in Control – No more provider blackouts or unexpected failures.

For businesses that process high transaction volumes, operate globally, or work with multiple payment providers, the Routing Simulator is a must-have tool.

The Future of Payment Routing is Here

With paytech’s Routing Simulator, payment processing is no longer a guessing game.

🔹 Test. Optimise. Deploy.

🔹 Reduce failures. Increase conversions.

🔹 Give your customers the seamless payment experience they expect.

💡 Try it today and take control of your payment flows. 🚀