paytech Achieves PCI DSS Level 1: Elevating Payment Security and Trust

PCI DSS certification

Payment card

security

standard.

standard.

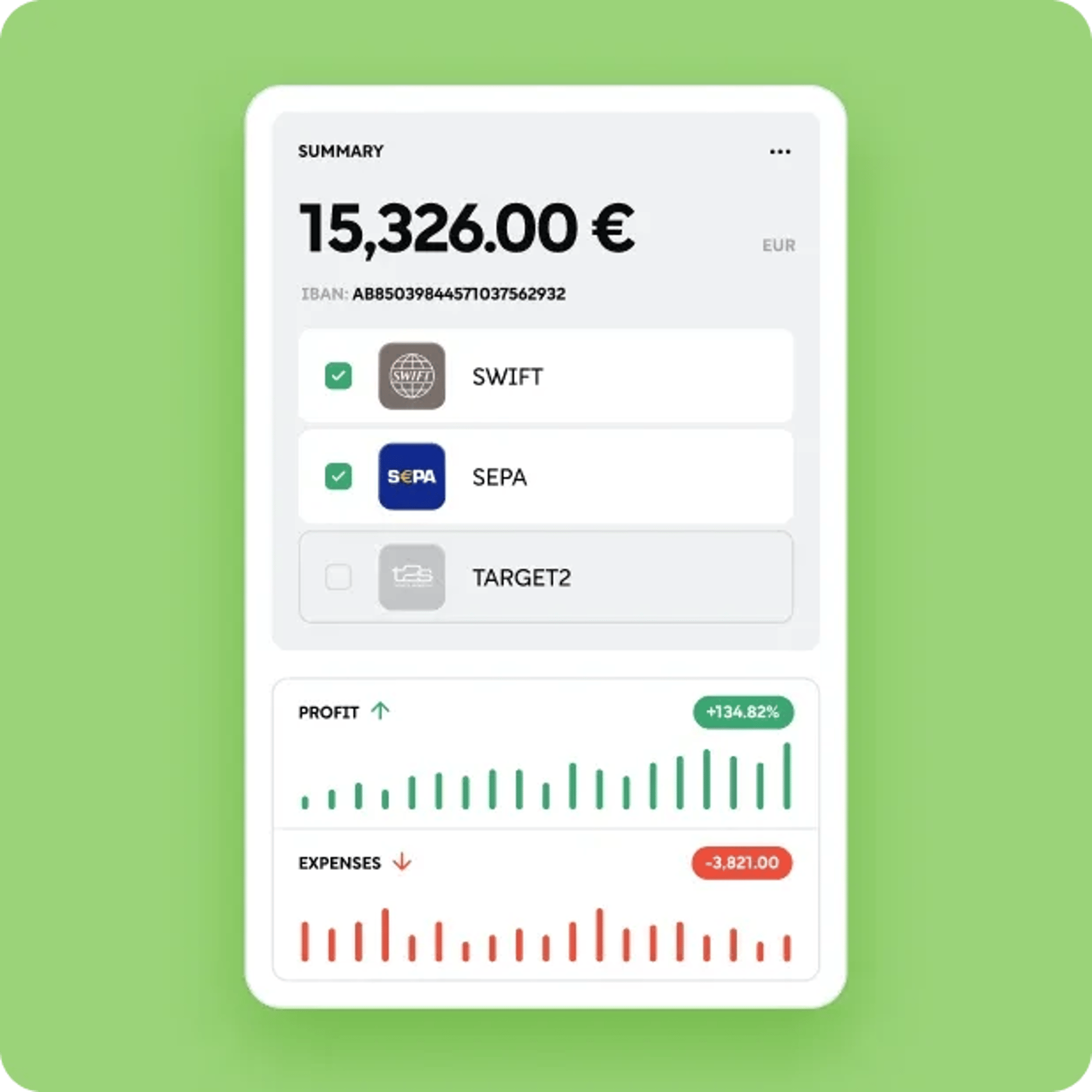

PCI DSS is a global standard, and compliance is crucial for any business involved in handling payment card data.

Compliance with PCI DSS involves implementing specific security measures and best practices to protect sensitive cardholder data from theft and misuse.

PCI DSS is a global standard, and compliance is crucial for any business involved in handling payment card data.

Compliance with PCI DSS involves implementing specific security measures and best practices to protect sensitive cardholder data from theft and misuse.

Why do you need PCI DSS

Implementing PCI DSS is

essential for  businesses

businesses

to protect sensitive

customer information,

customer information,

maintain legal compliance,

prevent financial

losses,

and  build trust with

build trust with

customers. It is a

proactive

approach to

cybersecurity that is

cybersecurity that is

crucial

in today's digital

payment landscape.

PCI DSS

compliance

levels.

levels.

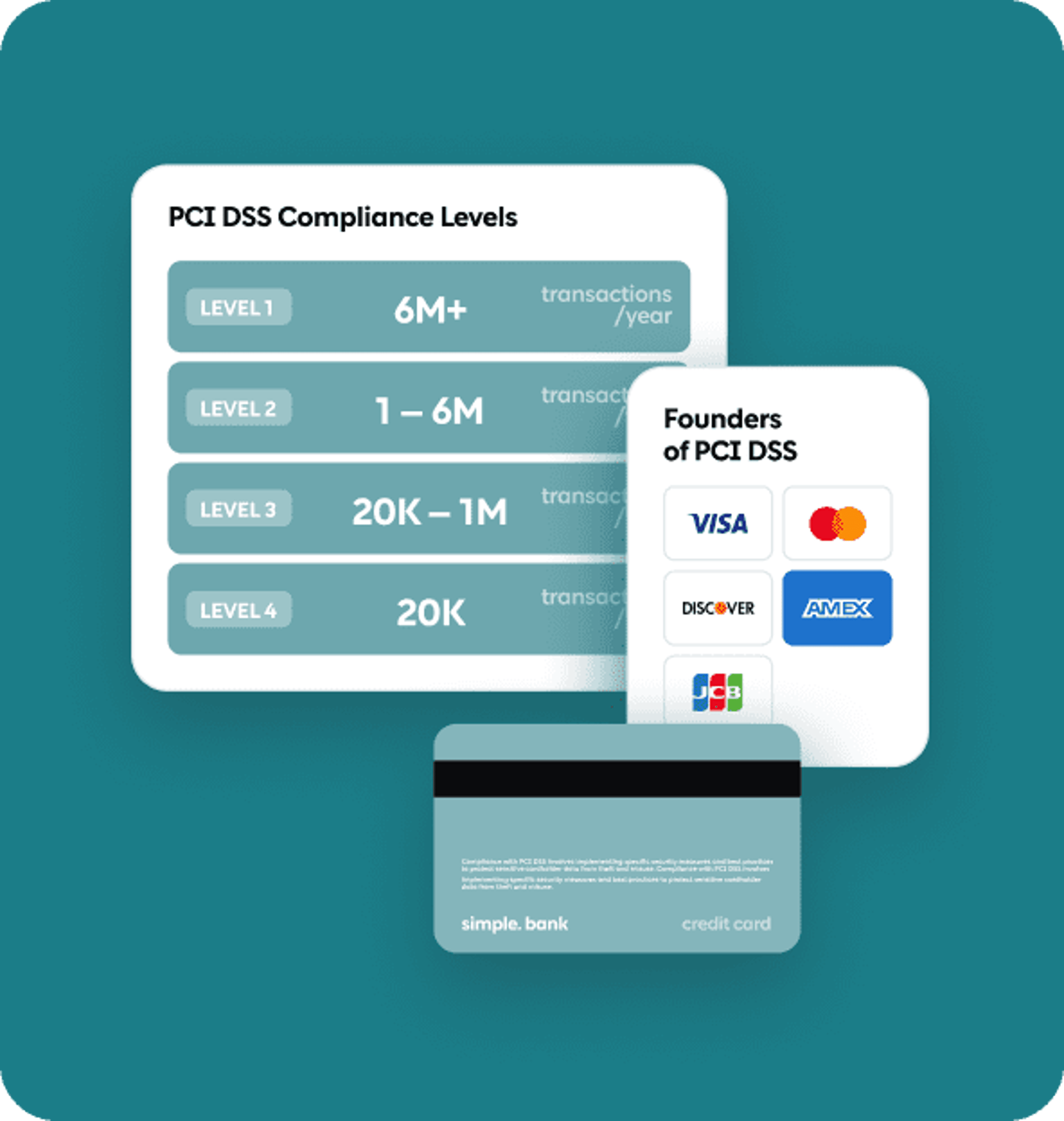

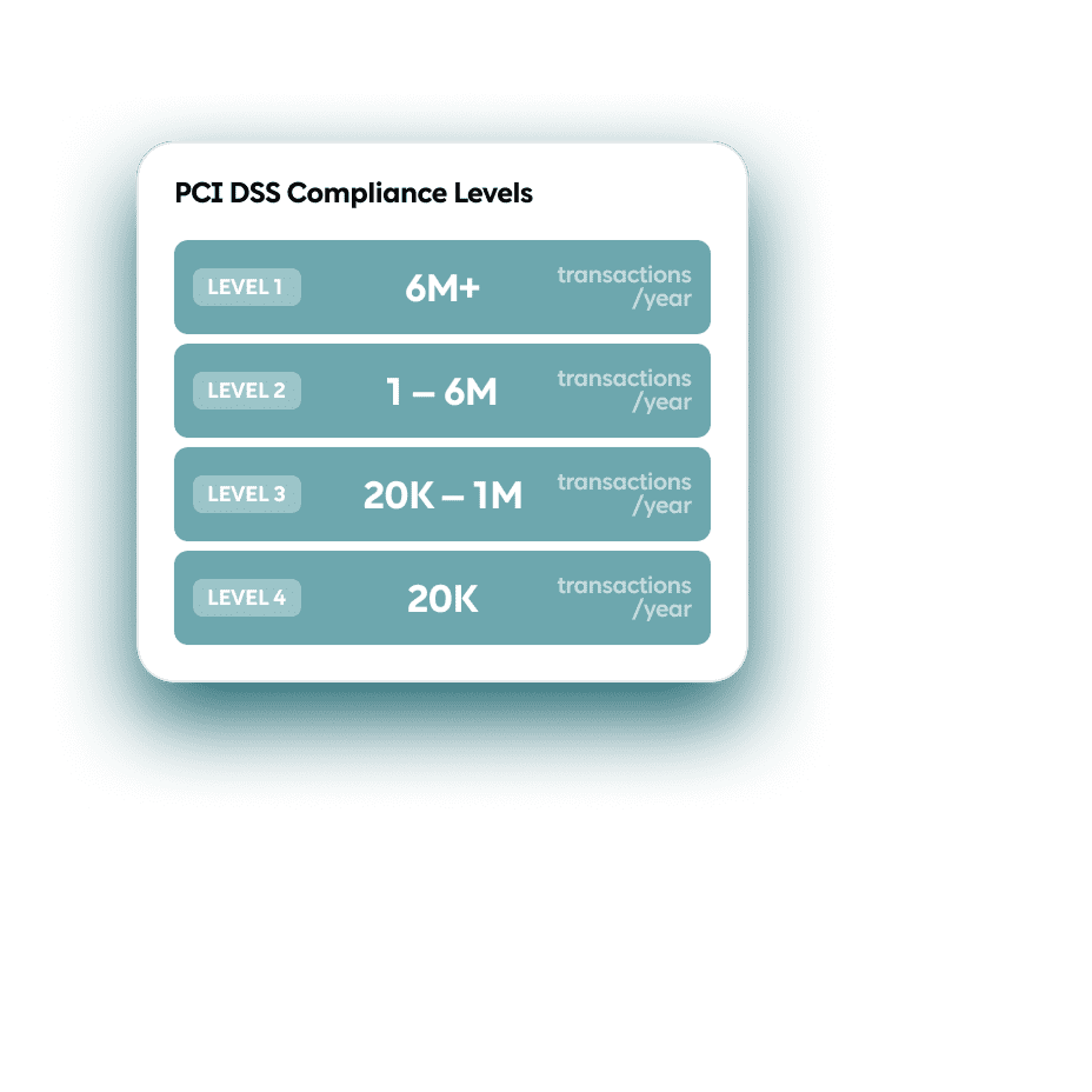

| Merchant level | Merchant definition | Requirement |

| Level 1 | More than six million transactions annually across all channels, including e-commerce | Annual Onsite PCI Data Security Assessment and Quarterly Network Scans |

| Level 2 | 1,000,000 – 5,999,999 transactions annually | Annual Self-Assessment and Quarterly Network Scans |

| Level 3 | 20,000 – 1,000,000 e-commerce transactions annually | Annual Self-Assessment and Quarterly Network Scans |

| Level 4 | Less than 20,000 e-commerce transactions annually, and all merchants across channel up to 1,000,000 VISA transactions annually | Annual Self-Assessment and Annual Network Scans |

Merchant level

Level 1

Merchant definition

More than six million transactions annually across all channels, including e-commerce

Requirement

Annual Onsite PCI Data Security Assessment and Quarterly Network Scans

Merchant level

Level 2

Merchant definition

1,000,000 – 5,999,999 transactions annually

Requirement

Annual Self-Assessment and Quarterly Network Scans

Merchant level

Level 3

Merchant definition

20,000 – 1,000,000 e-commerce transactions annually

Requirement

Annual Self-Assessment and Quarterly Network Scans

Merchant level

Level 4

Merchant definition

Less than 20,000 e-commerce transactions annually, and all merchants across channel up to 1,000,000 VISA transactions annually

Requirement

Annual Self-Assessment and Annual Network Scans

PCI DSS

12 requirements.

Build and maintain a secure network

1. Install and maintain a firewall configuration to protect cardholder data

Build and maintain a secure network by using firewalls to protect cardholder data.

Build and maintain a secure network

2. Do not use vendor-supplied defaults for system passwords and other security parameters

Change default passwords and security parameters to enhance the security of systems and applications.

Protect cardholder data

3. Protect cardholder data

Protect stored cardholder data through encryption, hashing, or other secure methods.

Protect cardholder data

4. Encrypt transmission of cardholder data across open, public networks

Use strong cryptography and security protocols to secure the transmission of cardholder data over public networks.

Maintain a vulnerability management program

5. Use and regularly update anti-virus software or programs

Deploy and maintain anti-virus software to protect systems from malicious software, and ensure it is kept up to date.

Maintain a vulnerability management program

6. Develop and maintain secure systems and applications

Protect stored cardholder data through encryption, hashing, or other secure methods.

Implement strong access control measures

7. Restrict access to cardholder data by business need-to-know

Protect stored cardholder data through encryption, hashing, or other secure methods.

Implement strong access control measures

8. Assign a unique ID to each person with computer access

Use unique identifiers for each individual with access to computer systems, and limit access based on job roles.

Implement strong access control measures

9. Restrict physical access to cardholder data

Implement physical security measures to prevent unauthorized access to cardholder data.

Regularly monitor and test networks

10. Track and monitor all access to network resources and cardholder data

Implement logging and monitoring to track and review access to network resources and cardholder data.

Regularly monitor and test networks

11. Regularly test security systems and processes

Conduct regular security testing and assessments to identify vulnerabilities and weaknesses in systems and processes.

Maintain an information security policy

12. Maintain a policy that addresses information security for all personnel

Develop and maintain a comprehensive security policy that addresses information security for all employees and contractors.

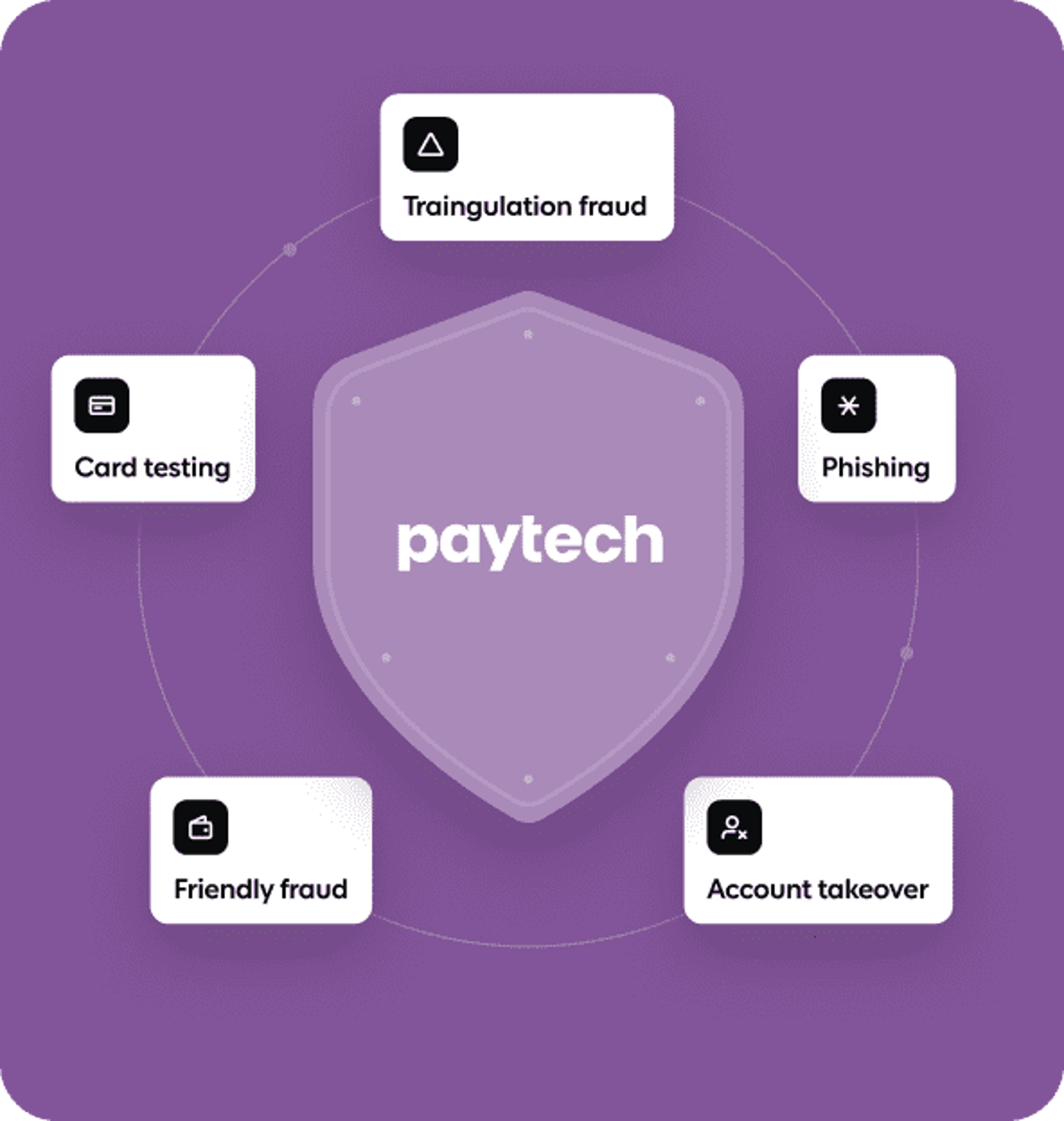

How paytech

can help with

PCI DSS

PCI DSS

certification?

paytech is your strategic partner in achieving PCI DSS certification by providing expert consultation, assessing your current security posture, and recommending tailored solutions. Our team assists in implementing technical measures, including encryption and secure network architecture, and helps develop comprehensive security policies.

We help your organization adapt to changes, ensuring a secure payment environment and reducing the risk of data breaches.

Contact

our Sales

team.

team.

Provide your information to help our Sales

team better understand your needs.

Thanks for enquiring

with us.

with us.

We’ll contact you directly to get things

moving – we may ask you for additional

information about your enquiry.