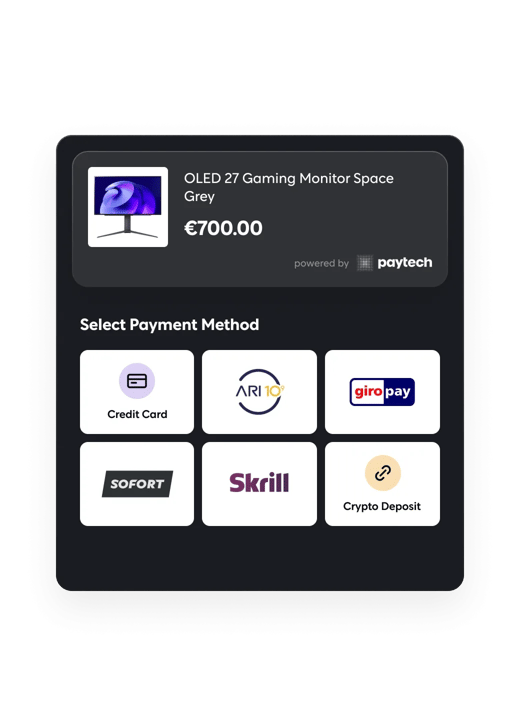

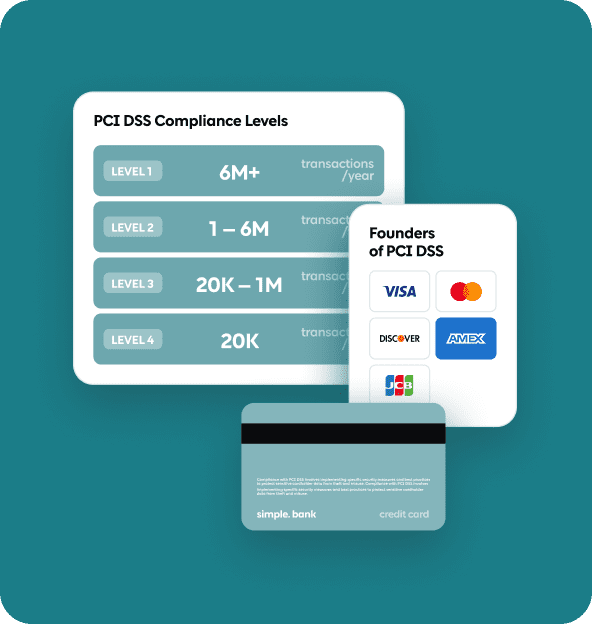

paytech Achieves PCI DSS Level 1: Elevating Payment Security and Trust

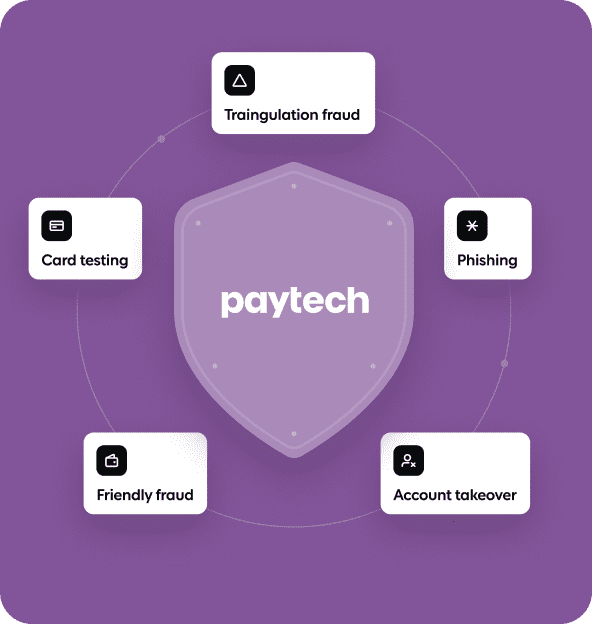

Fraud prevention

Fortify your

defenses:

harnessing

harnessing

powerful fraud

prevention tools.

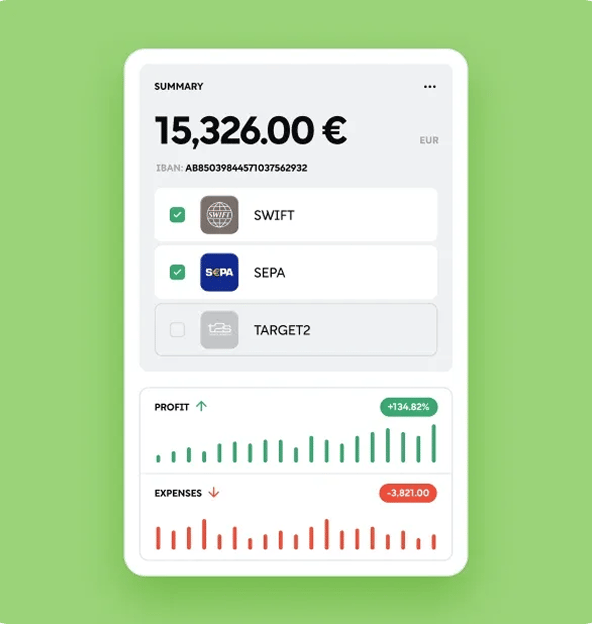

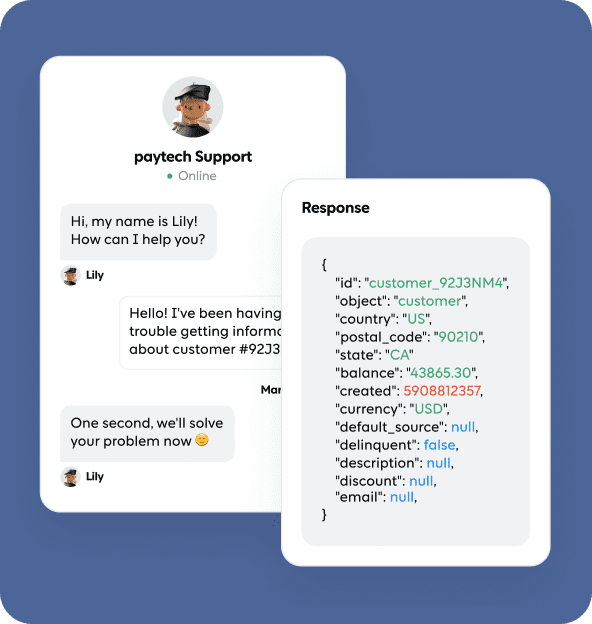

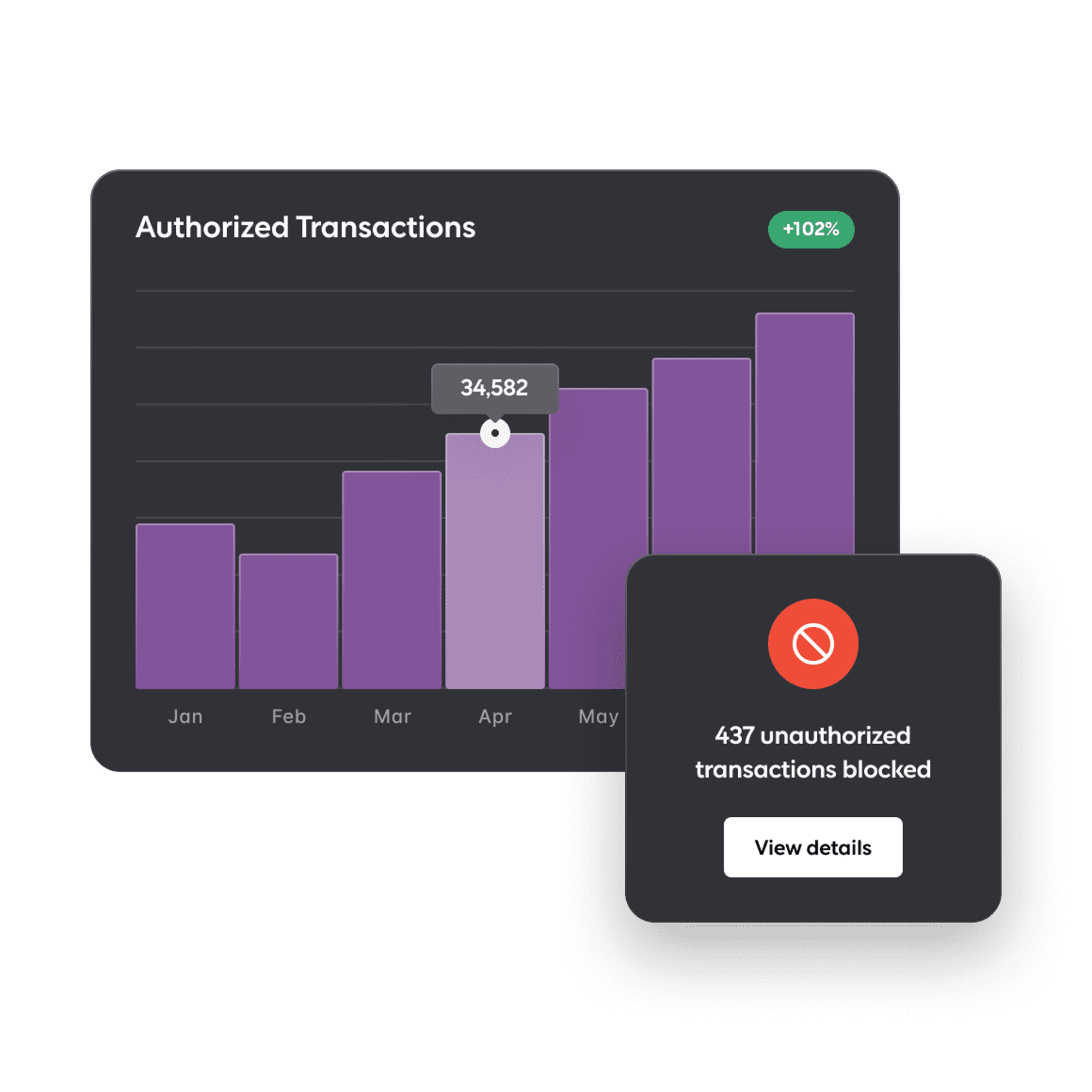

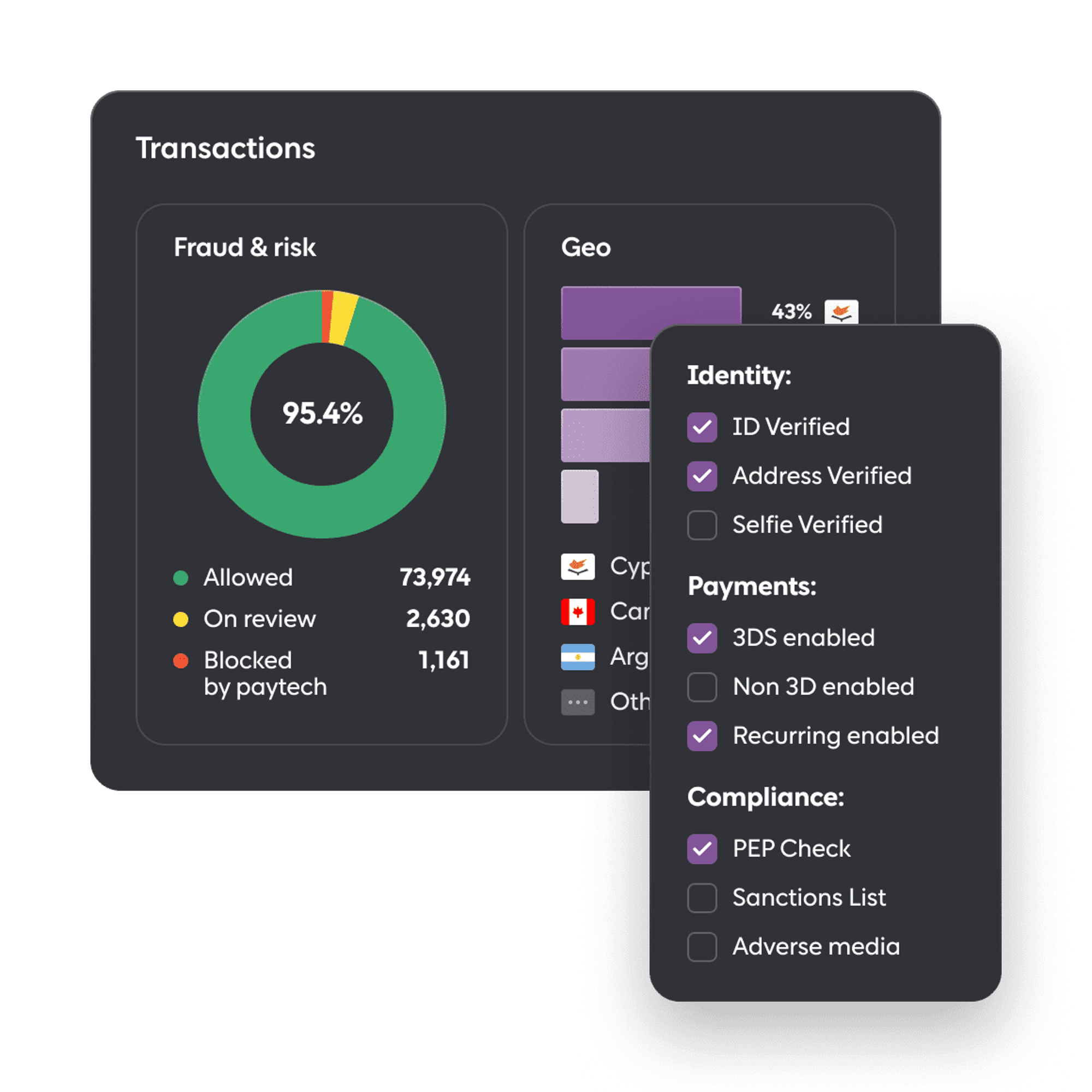

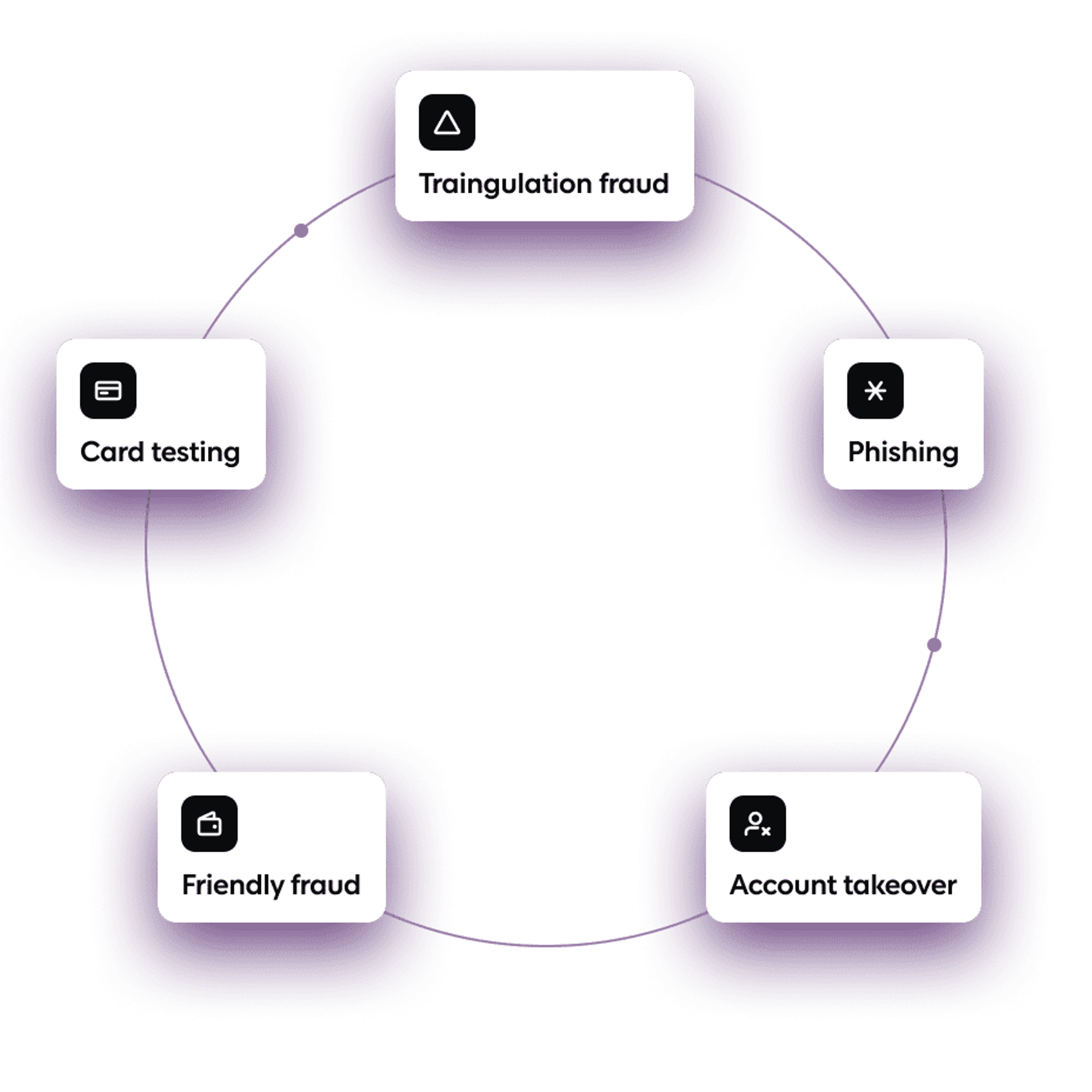

At paytech, we prioritize robust fraud prevention in the digital era. Our suite of tools safeguards your business, builds customer trust, and helps you tackle evolving online fraud challenges.

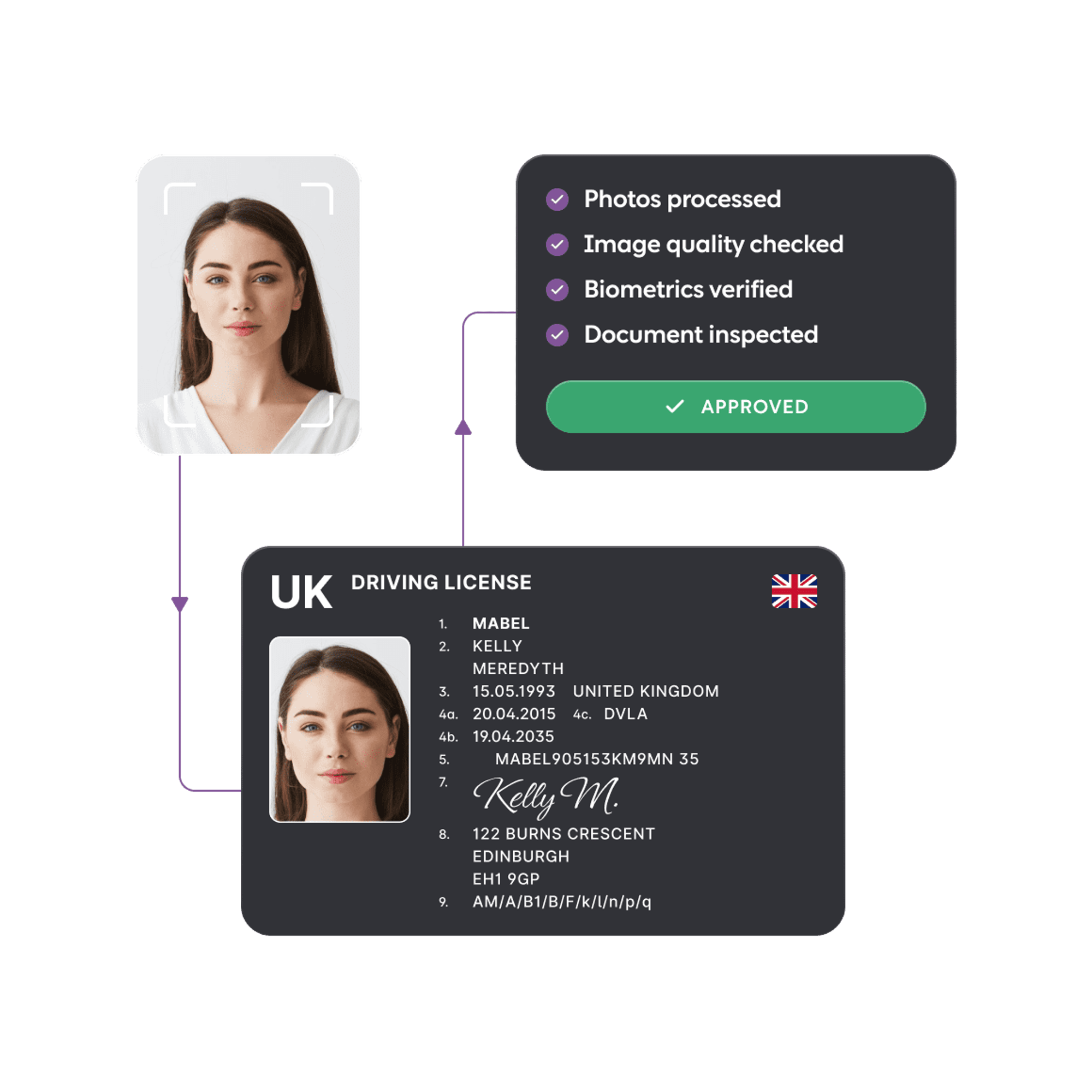

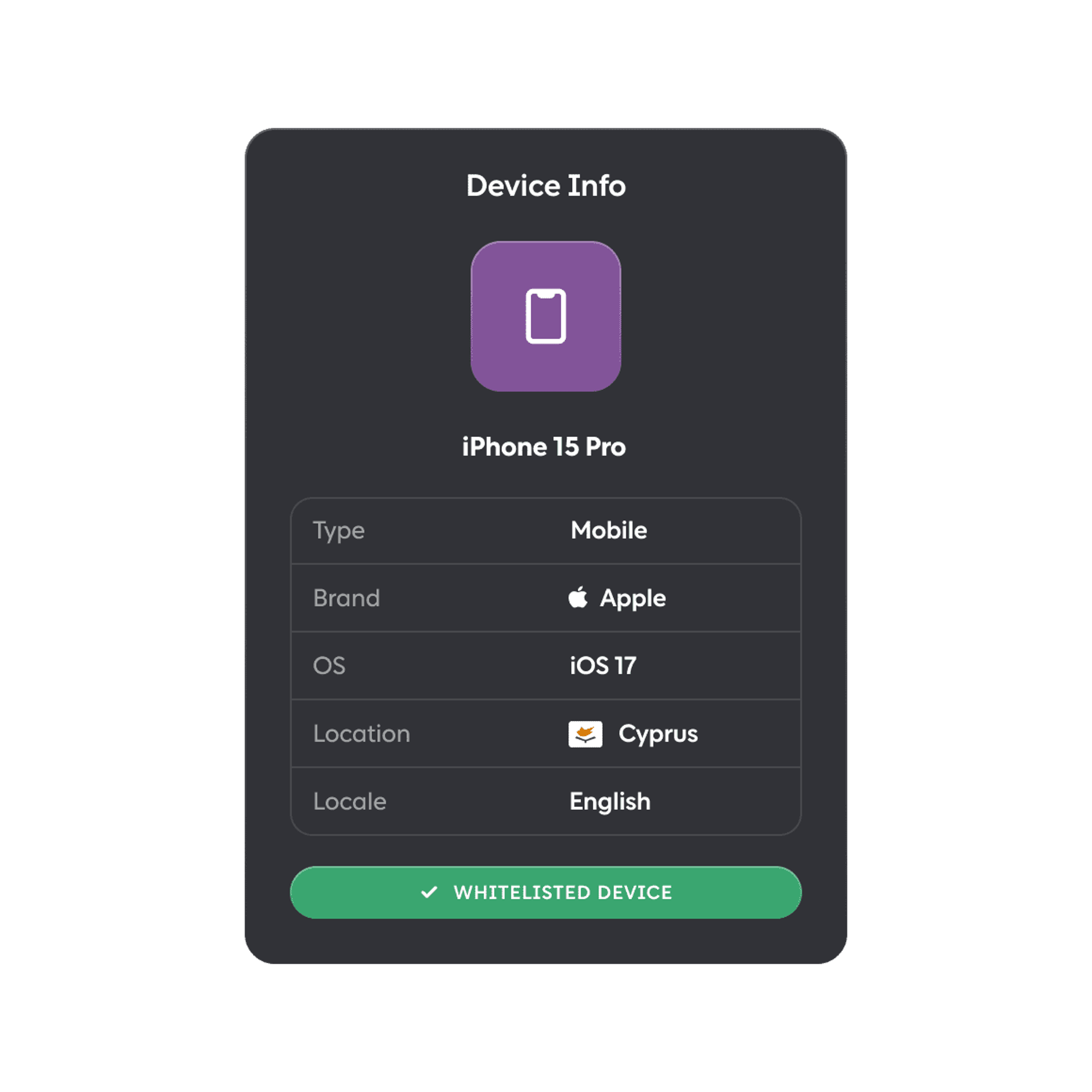

Real-time identity verification and machine learning-driven behavior analysis empower you to stay ahead of fraud threats, ensuring the security of your business.

At paytech, we prioritize robust fraud prevention in the digital era. Our suite of tools safeguards your business, builds customer trust, and helps you tackle evolving online fraud challenges.

Real-time identity verification and machine learning-driven behavior analysis empower you to stay ahead of fraud threats, ensuring the security of your business.

Learn more

about key

features.

features.

Contact

our Sales

team.

team.

Provide your information to help our Sales

team better understand your needs.

Thanks for enquiring

with us.

with us.

We’ll contact you directly to get things

moving – we may ask you for additional

information about your enquiry.