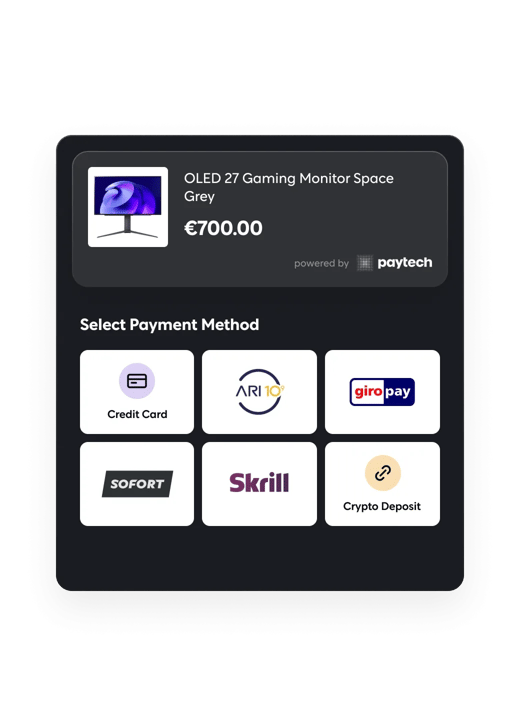

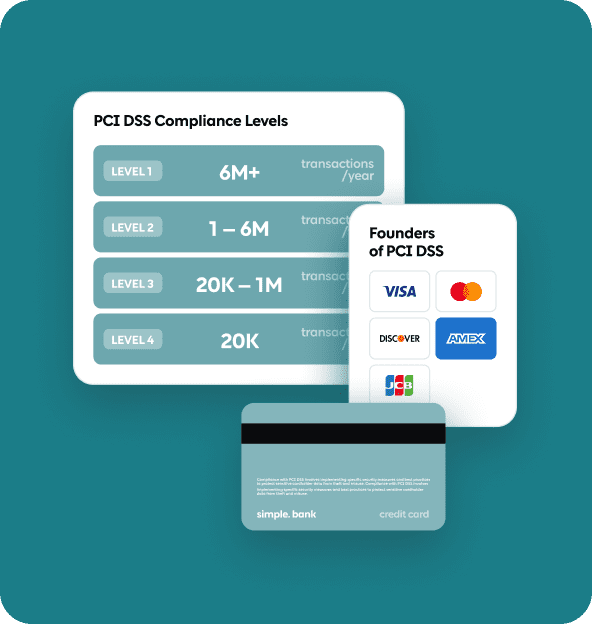

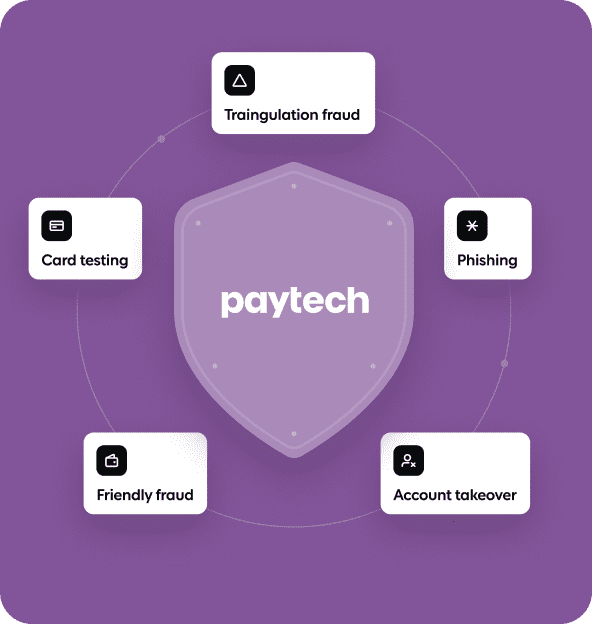

paytech Achieves PCI DSS Level 1: Elevating Payment Security and Trust

Get Started.

We’d love to find the best solution for your business.

Thanks for

additional

info!

info!

Our team will process the provided information

and provide you a personalized offer soon.