Every second counts when it comes to payments, and interruptions aren’t an option. For high-traffic e-commerce platforms or high-stakes industries, maintaining smooth, seamless payments—even when switching providers—is essential. This ensures customers can rely on you, keeping revenue steady and trust intact.

Why Seamless Provider Switching Matters

Payment provider outages can be costly—more than you may think. A report from the Financial Times highlights how even a brief disruption can lead to significant revenue loss and potentially harm your brand’s reputation, especially in sectors with high transaction volumes. To put it into perspective, research from Gartner estimates that IT downtime costs businesses around £4,300 per minute. That’s not a price anyone wants to pay.

So, how do you avoid this? By having the ability to switch between payment providers without missing a beat. It’s not just about avoiding downtime; it’s about maintaining the seamless transaction experience your customers expect.

The Role of Smart Routing and Failover Solutions

To achieve this, smart routing and failover solutions are your best friends:

- Smart Routing: Think of this as your transaction’s GPS, always finding the most efficient route to ensure payments are processed quickly and cost-effectively. TechCrunch reports that businesses using smart routing save billions annually by cutting down transaction costs and improving approval rates.

- Failover Solutions: When one payment provider stumbles, a failover system automatically reroutes transactions to another provider, keeping things running smoothly. According to Finextra, companies that deploy failover systems enjoy an impressive 99.99% uptime, meaning they stay operational even during provider outages.

Why It Matters for Your Business

For businesses where transaction volumes are high and operational reliability is non-negotiable, these technologies are game-changers. They ensure that your business doesn’t just survive during peak periods—it thrives. And when it comes to global markets, where different regions have different preferred payment methods, being able to switch seamlessly between providers is essential to keeping your customers happy and your transactions flowing.

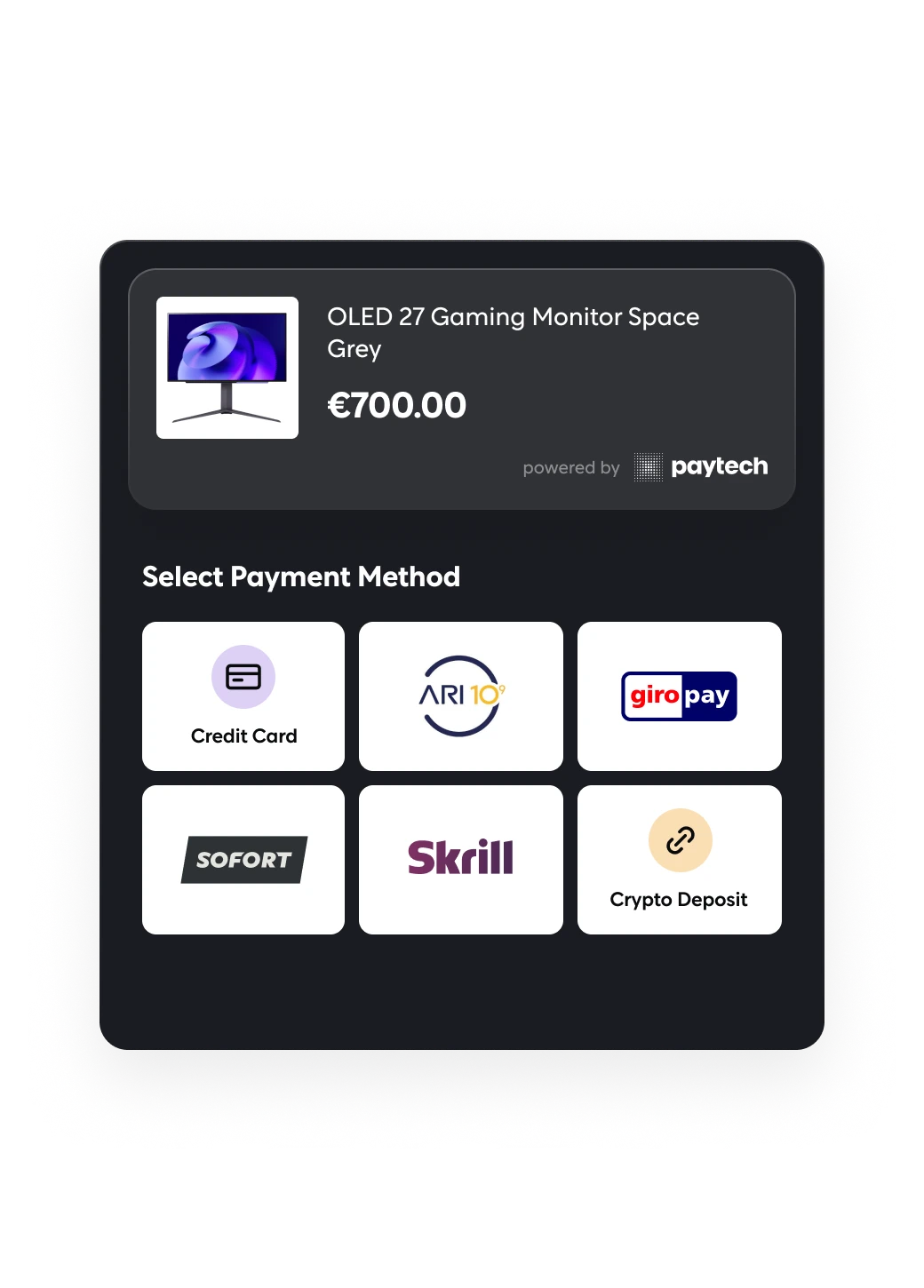

How paytech Can Help

At paytech, we’re all about making sure your payments don’t miss a beat. Our solutions are designed to keep your transactions flowing smoothly, even when switching providers:

- Smart Routing: Our advanced smart routing technology ensures your transactions always take the fastest, most cost-effective path, keeping your payment processing quick and reliable.

- Failover Chains: Should disruptions occur, our failover systems automatically kick in, rerouting transactions so that your operations stay seamless. This means your business can continue processing payments without interruption, even if one provider experiences issues.

- Strategic Cost Management: By dynamically switching between providers based on real-time data, our solutions help you manage costs effectively while maintaining top-notch service.

When you choose paytech, you’re choosing a partner dedicated to keeping your payment systems robust, reliable, and ready for anything. Let’s make sure your transactions never skip a beat. Get in touch with us to explore how we can support your business.