The payment landscape has become pretty cutthroat lately. With hundreds of providers offering these services and the option of building your own system from scratch, deciding on what or whom to settle on can be quite tricky.

However, for many businesses, partnering with a white-label payment provider could be a smart, efficient way to enter the market, saving you from the headache and potential pitfalls that come with building your own infrastructure. That said, a lot of thinking should go into selecting the right white-label provider, as it could impact your revenue, customer experience, and operational efficiency.

Many of the operators in the space offer similar services, meaning you have to look out for key differentiators, including customization, speed, security, and scalability, if you are to make the right choice for your business. So, how do you choose?

What is a White-Label Payment Solution?

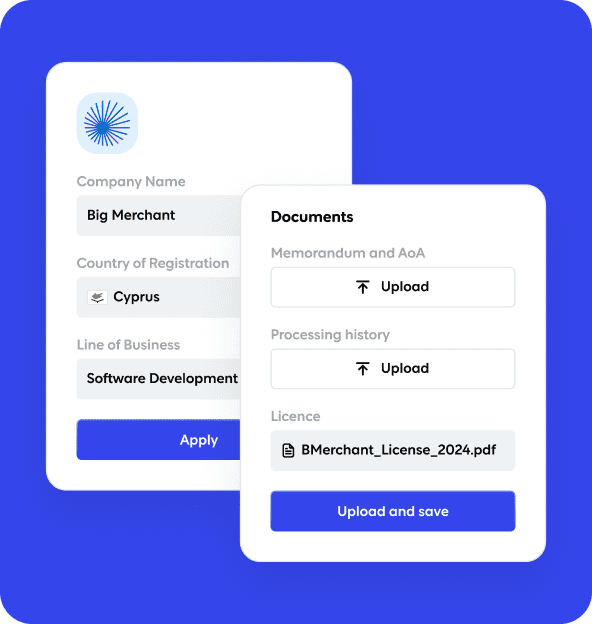

For the uninitiated, a white-label payment solution is a ready-made payment processing platform that lets you brand it as your own. The provider handles the backend, managing transactions, ensuring compliance, and so forth, allowing you to concentrate on growing your business.

What to Look For in a Provider

Here are the key factors to consider:

1. Customisation: Your Brand, Your Rules

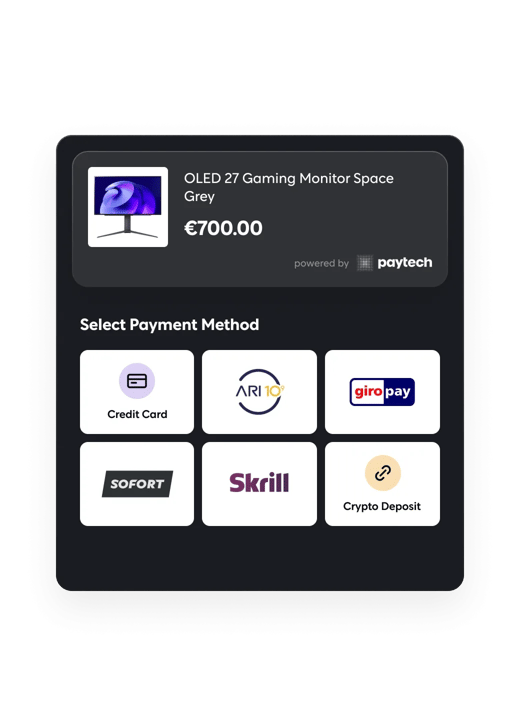

Brand identity is vital to any business, and a true white label should offer complete control over the checkout experience. Some players in the sector may impose brand restrictions or force your business into rigid templates, which, according to a past study by the Baymard Institute, led to a 13-22% drop in conversion rates.

Then there are providers like paytech, which not only give you the ability to fully customize your UI without coding but also lets you remove all third-party branding, ensuring your identity remains foremost. We can also tailor your transaction flows to match your business model, whether subscriptions or one-click payments.

2. Speed of Deployment

It can take anywhere from 6 to 12 months to build an in-house payment gateway. Such delays can lead to missed opportunities and lost revenue. Additionally, you’ll have to deal with the extra costs and numerous inconveniences that could crop up as a result of having to manage your own gateway.

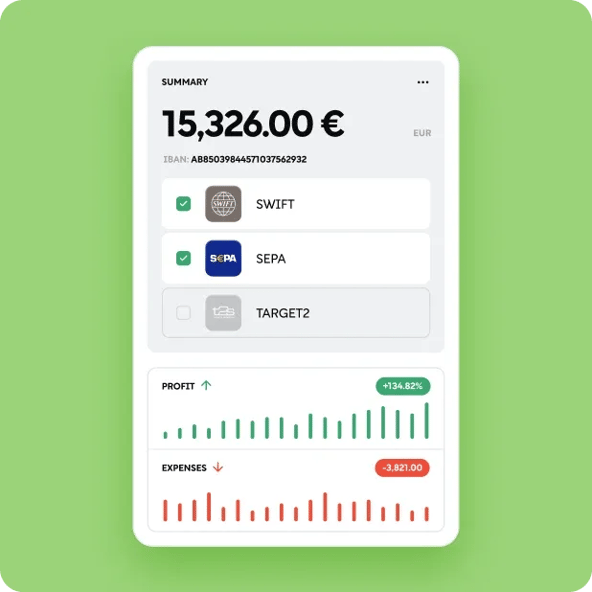

However, white-label solutions can cut that time down considerably. For instance, paytech usually gets a system integrating more than 700 payment methods and a no-code dashboard up and running in just a few days.

3. Reliability and Security

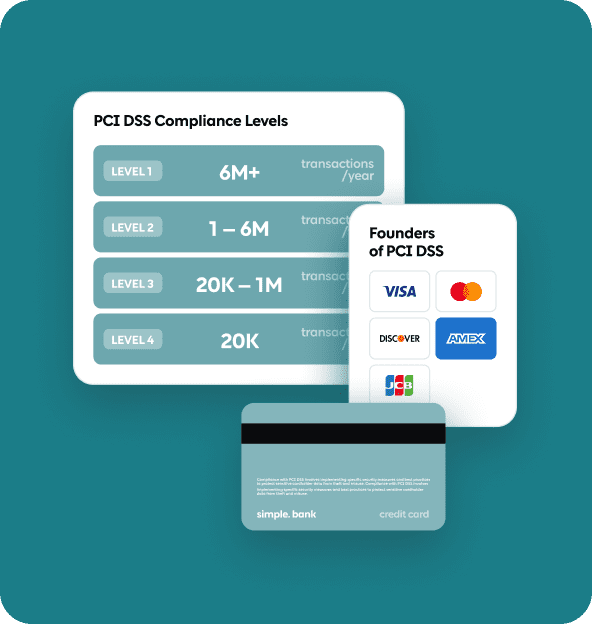

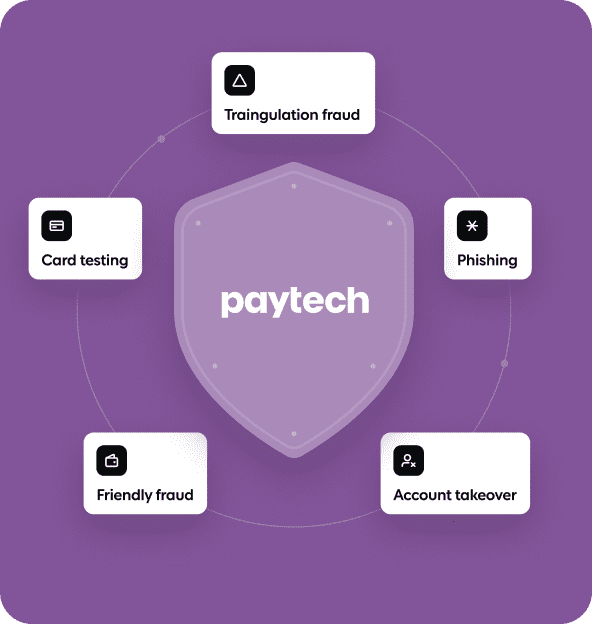

Who wants a payment system that crashes or leaves sensitive data vulnerable? Before you choose a provider, make sure they offer top-notch security, including dedicated PCI DSS compliance, data encryption, and real-time fraud detection. Furthermore, you need to check their uptime record and how quickly they respond to incidents.

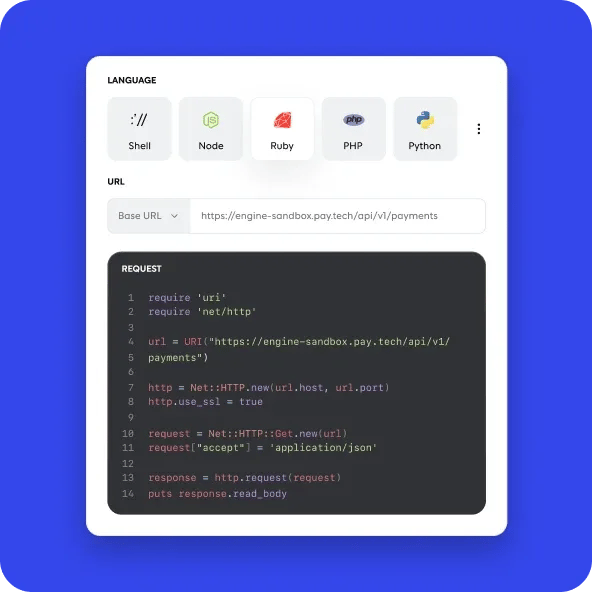

4. Seamless Integration

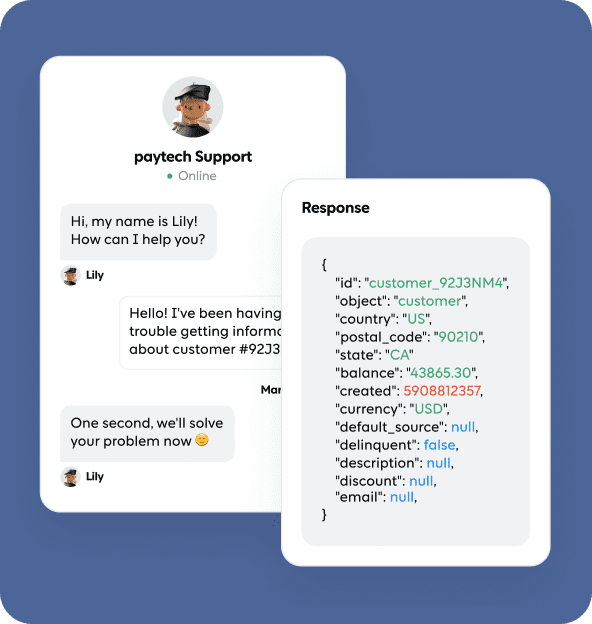

There’s no way integration should feel like rocket science. At a minimum, your provider must offer you easy-to-use APIs, SDKs, and plugins that actually work with your existing system. And that’s not all; the technical team should be available to you at all times, especially during the early deployment stage when you are still learning the ropes.

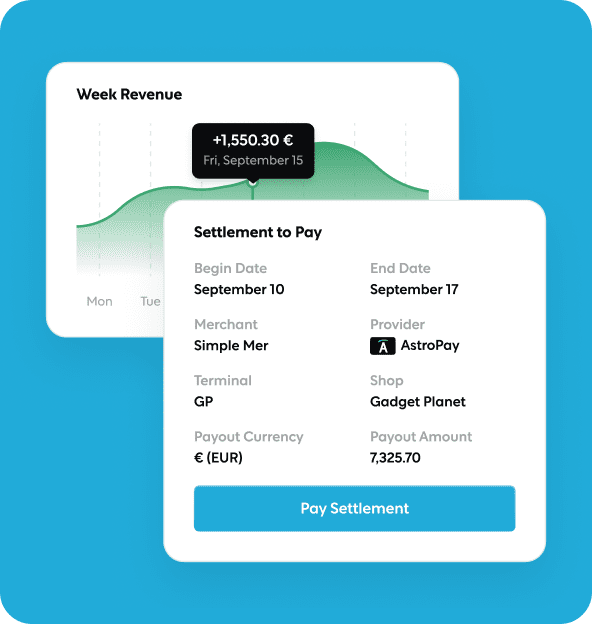

5. Scalability: Grow Without Constraints

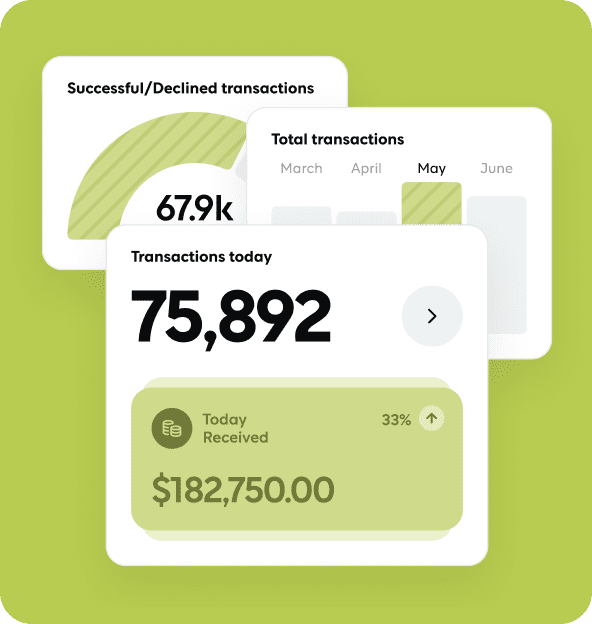

Anyone going into business will harbor ambitions of expansion, however modest. As such, it is imperative that you find a payment provider that can scale up with you. Some gateways may struggle to add new payment methods or handle traffic spikes, which may lead to unwanted downtimes during peak sales.

However, there are those that can comfortably handle thousands of transactions per second (TPS), a good example being paytech, which uses cloud-based infrastructure to push through up to 10,000 TPS.

Making Your Decision

Ultimately, your choice of provider should align with your business goals, and give you all the flexibility, security, and support you need. Never rush the decision; take your time to evaluate all your options keenly, considering the criteria spelled out above. In that way, you’ll be sure to select a partner who meets your current needs and is able to scale up with you as your business grows.

If you are ready to explore how a white-label payment solution can accelerate your expansion, contact us today to learn more.